From Voluntary to Mandatory: Your Essential Guide to TCFD Reporting

In the world of corporate sustainability, the alphabet soup of acronyms can be overwhelming. However, if there is one framework that has fundamentally shifted how businesses view the relationship between fiscal responsibility and climate, it is the TCFD (Task Force on Climate-related Financial Disclosures).

What began in 2017 as a research effort led by Mark Carney (former Governor of the Bank of England) and Michael Bloomberg (founder of Bloomberg L.P. and former New York City Mayor) has now become the global gold standard for climate risk reporting. At its core, the TCFD was designed to help the financial community understand how natural disasters and climate change impact an organization’s bottom line.

Why TCFD Reporting is More Than Just a "Sustainability" Issue

For years, climate change was often treated as an out-of-reach, long-term concern—something for future leadership of companies to worry about closer to 2050. The TCFD changed that narrative by framing climate change as an ongoing material financial issue.

If your primary manufacturing facility is in the path of a hurricane, or if your largest supplier is located in a region prone to drought, that is a risk to your shareholders and your bottom line today. TCFD reporting moves climate risk out of the "sustainability bucket" and places it squarely in the "risk management bucket," alongside geopolitical instability and cybersecurity.

Learn more about how this shift is being navigated across various industries in Beehive’s Enterprise Climate Risk Management course.

The Key Components of a TCFD Report

The TCFD framework is built around four core pillars and 11 specific questions designed to standardize how companies disclose climate-related financial risks. When you prepare a report, you are expected to address:

1. Governance

Who in your company has oversight of climate-related risks? This section looks at the board’s role and management’s responsibility in assessing and managing these issues.

2. Strategy

What are the actual and potential impacts of climate-related risks and opportunities on your business, strategy, and financial planning? This involves assessing two main types of risks:

Physical Risks: The direct impact of weather-related events (e.g., wildfires, floods, extreme heat).

Transition Risks: The financial risks stemming from a changing society, such as new carbon laws, shifts in market expectations, or technological changes.

3. Risk Management

How does your company identify, assess, and manage these risks? This section focuses on how climate risk is integrated into your existing risk management taxonomy.

4. Metrics and Targets

What data are you using to measure success? This typically includes carbon emissions (Scope 1, 2, and 3) and specific targets the company has set to mitigate potential climate risk exposure.

Where are TCFD Reports Submitted?

Initially, TCFD reporting was a voluntary effort embraced by the private sector to signal transparency to investors. However, the landscape has shifted rapidly from "optional" to "required."

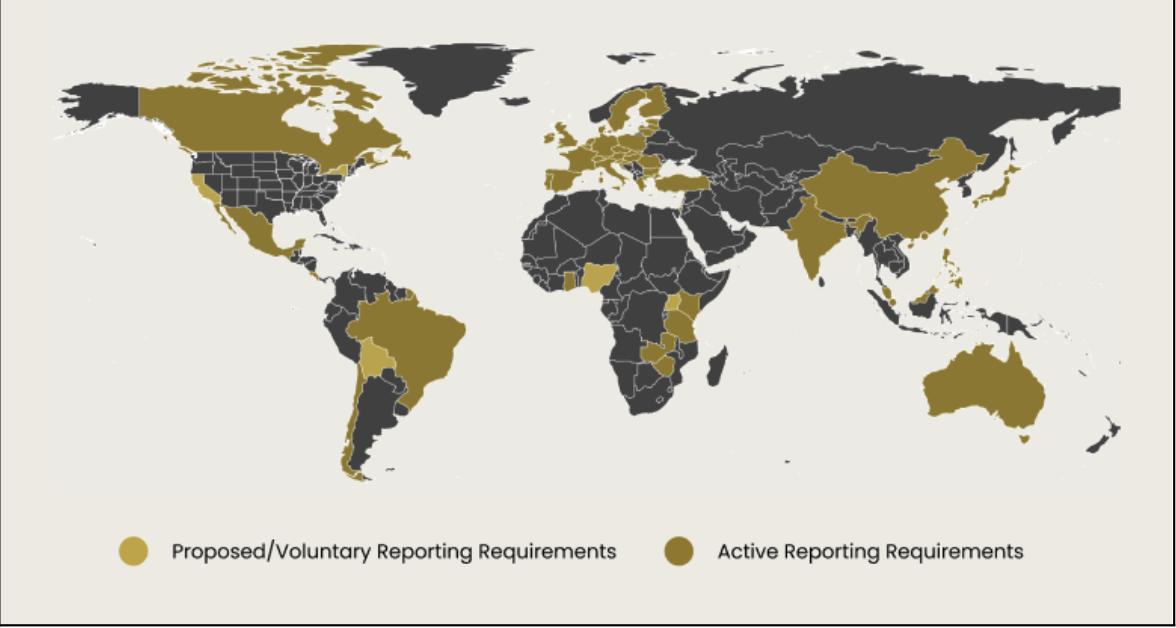

With TCFD reporting requirements now codified into law across six continents, coverage extends to jurisdictions accounting for 60% of global GDP. The following visual illustrates the current regulatory landscape, identifying where these disclosures are mandatory, proposed, or voluntary for major listed companies, banks, and other institutions.

Figure: Overview of international coverage TCFD-aligned reporting frameworks

How Companies are Reporting Today

There is no "one-size-fits-all" approach to a TCFD report. Depending on your industry and resources, reports can vary significantly:

Detailed and Design-Forward: Companies like HubSpot, Take-Two Interactive, and US Steel produce highly visual, deep-dive reports that include extensive appendices and identifying specific risks.

Simple and Direct: Platforms like GitLab, Pinterest, and EcoLab take a more streamlined approach, focusing on a few pages of clear, concise boxes and text.

The goal isn't necessarily to produce a lengthy, technical document. It’s to provide an honest, data-driven summary of your company’s resilience.

Streamlining the Disclosure Process with Beehive

Traditionally, a TCFD report required hiring expensive consultants for a six-month process involving dozens of interviews and manual data entry. At Beehive, we’ve transformed this timeline from months to minutes.

Our software allows you to:

Automate Physical Risk Assessments: Instantly evaluate your offices, data centers, and supply chain against wildfires, floods, and extreme heat across multiple climate scenarios.

Assess Transition Risks: Access a massive library of peer-benchmarked risks and opportunities tailored to your industry.

AI-Drafted Reports: Our AI drafts your TCFD responses based on your specific data, which is then reviewed by our human subject-matter experts to ensure accuracy and compliance.

Peer Benchmarking: See how your competitors and peers are answering the same questions so you can ensure your transparency matches market expectations.

Figure: Beehive AI-enabled TCFD Report Generation Process

As regulations like California's SB 261 and the EU’s CSRD requirements loom on the horizon, understanding your financial exposure to climate change is no longer just a "nice to have." It is a legal obligation. Whether you are just starting your reporting journey or transitioning to the new reporting standards, Beehive is here to make the process accurate, data-driven, and fast.

To hear more on the topic, watch our previous webinar where our CEO, Adriel Lubarsky, dives into the topic of the TCFD framework, its background, its international momentum, and reporting requirements: