Four Lessons in Sustainability Strategy with Workiva’s Annalee Bloomfield

Sustainability is no longer a side project for the marketing or HR departments. Over the last decade, the field has undergone a seismic shift, moving from voluntary "feel-good" initiatives to a core function of corporate governance, compliance, and risk management.

Adriel recently sat down with Annalee Bloomfield, Vice President of Solutions - Sustainability, at Workiva (and former founder of Sustain.life), to discuss how the world’s largest companies are navigating this transition. From the emergence of the "ESG Controller" to the integration of climate risk into financial reporting, their conversation highlighted a clear reality: the era of "best effort" reporting is over, and the era of auditability is here.

Here are the four key takeaways from the conversation on the state of sustainability strategy.

1. Move From "Raising the Bar" to "Raising the Floor"

During her time at Walmart and the early days of Sustain.life, Annalee observed a recurring problem in supply chain sustainability. While "moonshot" individuals—passionate employees working three full-time jobs to drive change—existed, they weren’t a scalable solution.

For a company like Walmart to hit its goals, its entire supply chain (from global giants like Pepsi to small Christmas tree manufacturers) needs to participate. Many of these smaller suppliers are highly motivated to comply because their contracts depend on it, but they lack the expertise.

The Strategy: Instead of looking for more "superstar" performers, leadership should focus on providing tools that "raise the floor." This means giving the average manager—who wants to do a good job but isn't a sustainability expert—the software and guidance needed to produce accurate data without manual heroics.

2. The Rise of the ESG Controller

One of the most significant shifts in the corporate hierarchy is the birth of the ESG Controller. Annalee points out, “The one role that I see our customers hiring consistently and frequently and it's brand new is the ESG controller.” This role is increasingly being filled by professionals from the financial controllership who are "on loan" to sustainability teams, bridging fundamental understandings between financial responsibility and sustainability strategy.

Why the ESG Controller matters:

Auditability: As sustainability data moves into regulatory filings (like the 10-K), it requires the same level of rigor as financial data.

Gap Bridging: Sustainability data is often "messy" (utilities, estimates, and varying time series). The ESG Controller applies financial-grade controls to this non-financial data.

Process, Not Projects: They move the company away from "intern-led spreadsheets" toward automated, repeatable data trails that can survive a third-party audit.

3. Climate Risk and Carbon Accounting: Two Sides of the Same Coin

While often grouped together, carbon accounting and climate risk management require different internal approaches.

Carbon accounting is often a brand-new "language" for a business. No one in the company truly knows the carbon footprint of a product until the sustainability team asks for the data. It is an exercise in data collection and new reporting.

Climate risk, however, often has "ancestors" within the organization. While TCFD and CSRD requirements are new, the concepts of insurance loss rates, disaster recovery, and business continuity are not.

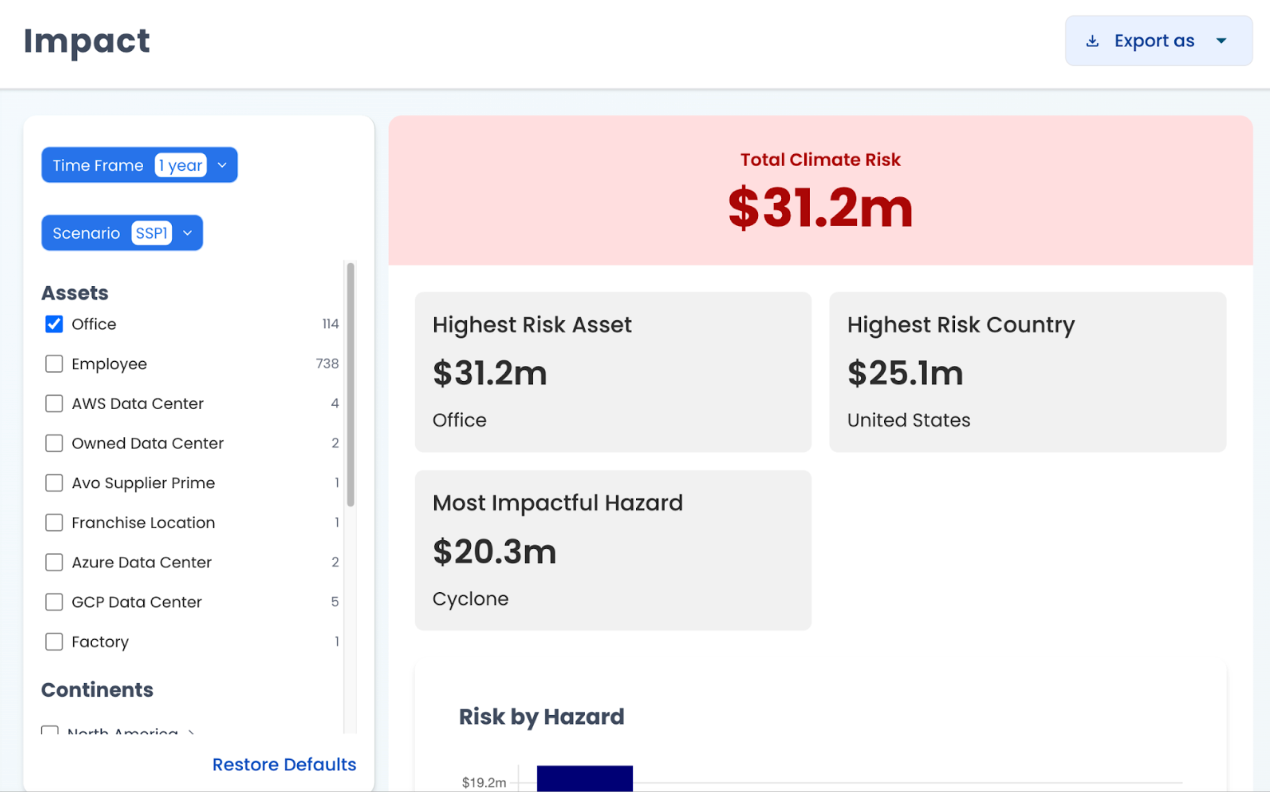

The Strategy: To successfully integrate climate risk into Enterprise Risk Management (ERM), sustainability leaders should act as connectors. Instead of building a "risk silo," they should leverage existing knowledge from facilities and insurance teams to show how climate impacts the risks the board already cares about—like succession planning, physical assets, and competitive standing. Active planning and risk management are made easy with Beehive’s auditable financial impact module:

Figure: Beehive’s “Impact” module shows the total climate risk across your assets in terms of financial impact

4. Using AI to Zoom In and Zoom Out

Artificial Intelligence has moved beyond the hype cycle and into the practical toolkit of the sustainability professional. Annalee highlighted two specific ways AI is helping teams "do more with less":

Zooming In (Data Quality): AI is exceptionally good at anomaly detection. It can scan thousands of rows of utility data to find "shaped" errors or outliers that a human eye might miss, ensuring the data is audit-ready.

Zooming Out (Strategy and Narrative): Sustainability leaders are often asked to be both tactical (calculating GHG) and strategic (presenting to the Board). AI acts as a "strategic intern," helping to draft disclosures for new jurisdictions (like California’s SB 253 or the CSRD) and preparing leadership for antagonistic questions from investors or rating agencies like the MSCI.

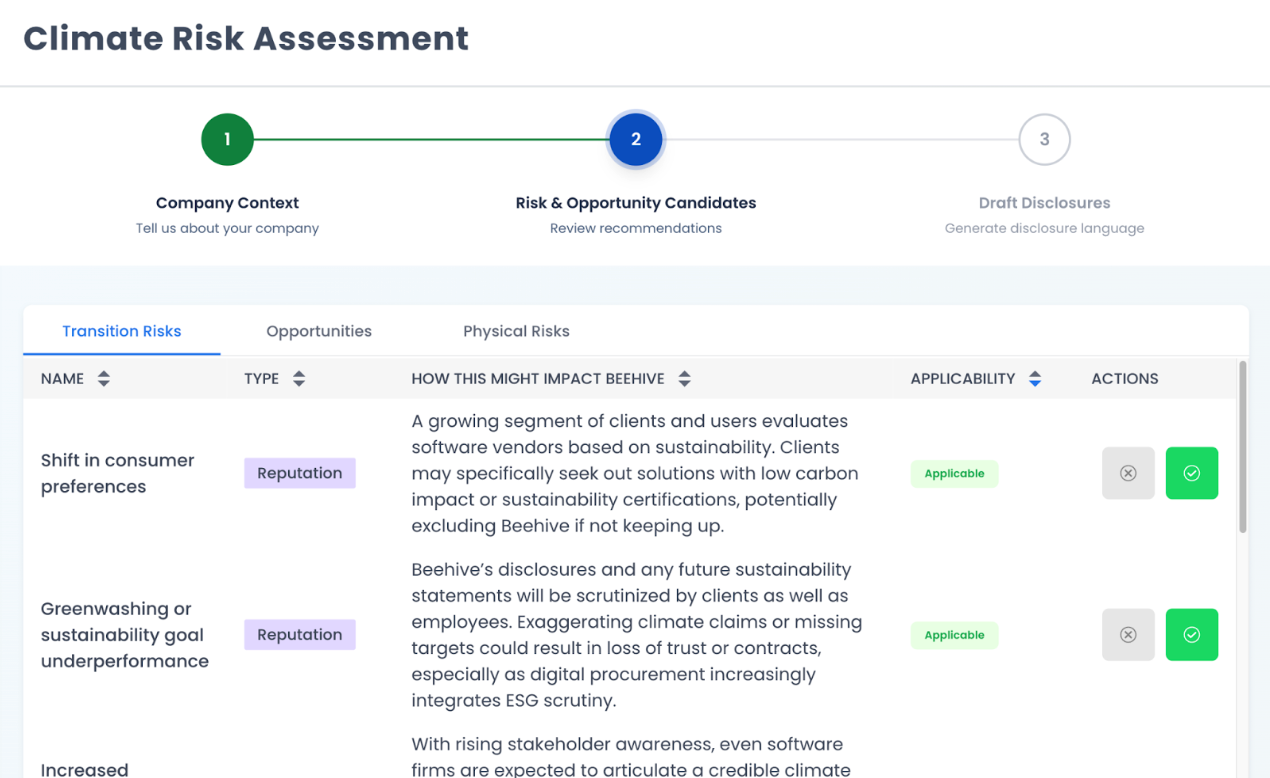

Figure: Beehive’s “Risk Assessment” module uses AI to instantly identify risks and opportunities within your organization based on your company’s data and documents (e.g., 10-K reports).

Looking Ahead: The Shift to Repeatable Processes

Annalee believes that the next four years will be defined by an "upward hill" of rigor. Companies currently reporting Scope 1 and 2 will soon face the complexities of Scope 3 and the looming requirement for limited—and eventually reasonable—assurance.

The most successful customers that Beehive and Workiva work with are those moving away from one-off consultant reports. As Annalee noted, consultants are vital for strategy and high-level planning, but the core data analysis and risk monitoring should be brought in-house. By building repeatable, software-driven processes today, companies can ensure that when the auditors arrive, the data isn't just a "best effort"—it’s a verifiable fact.

To hear more from the conversation between Adriel and Annalee, watch the webinar where they dive deep into sustainability strategy, the state of the market, regulatory reporting, and more: